TLDR: DON'T secure your network. Get a modern card terminal with P2PE (Point to Point Encryption) and acquirer who supports it - e.g. new-market products like Square or PayPal Here, which cost less than you think.

This transfers PCI-DSS responsibility away from you and to these billion dollar financial companies who are well equipped to handle it efficiently, at scale. Go encryption!

Complying with PCI-DSS is big work unless... (skip this)

PCI-DSS is serious business. Most small businesses do not have a breach. But if you do have a breach (which would most likely be crackers surveilling your credit card transactions for an extended period of time), you'll need to pay extremely painful penalties that have a (the figure I've heard is 90%) chance of bankrupting your small business.

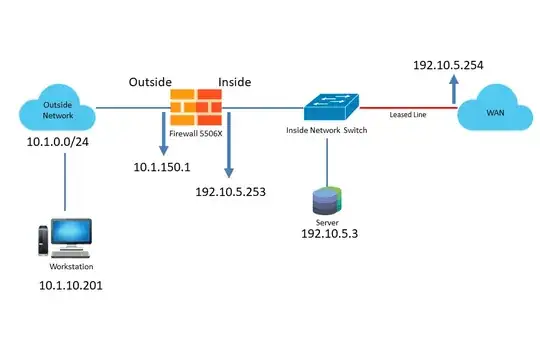

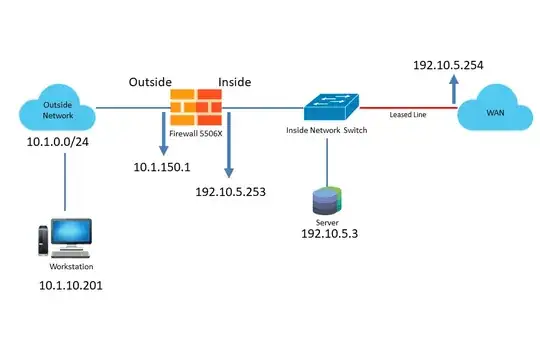

What is in scope for PCI is

- your card terminal

- the network it's on

- every PC, wait, device that can access that network

- and the WiFi bridged to that network

- including IoT: security cameras, Sense power monitor, and every silly WiFi-enabled gadget you bought on a lark and forgot all about

- every network that can access that network, and

- every PC, er, device on those networks.

- guest WiFi must be correctly set up to not be on this network

... unless you dodge it altogether, with P2PE

P2PE = Point to Point Encryption - essentially a VPN tunnel between the card reader device and the acquirer.

Square's first card reader was a simple magnetic tape head. Obviously, the Square app handled card data in the tablet. That placed the app, phone/tablet, network etc. in scope for PCI-DSS.

PayPal Here put an encryption processor inside the scanner fob itself. The fob itself talks to PayPal servers, via P2PE. The PayPal app simply passes the data through and can't read it (and neither can anyone else).

This does not place the app, phone and network in-scope for PCI-DSS. If the acquirer guarantees the fob is secure, then all you have to do is make sure your fob has not been physically tampered with.

If all your credit card activity is via P2PE standalone devices, then you don't need to PCI-DSS your network.

P2PE is the only way to go.

But unfortunately, a lot of acquirers (particularly the kind with roving salesmen, you know the ones) have not gotten the memo. They force you to spend thousands securing your networks. Why?

Because they are super resistant to change (chip cards, heh) and P2PE requires a huge expense of back-end tech that they can get by without. And of course you, the retailer, needs to buy a new P2PE reader, which is a tough pill to swallow after just spending a bunch on chip readers.

And your acquirer sold you an obsolete jalopy; that reader dates from 2012, before P2PE became popular. See?

Look at modern payment processors like Square or PayPal Here. At first glance, they look terrible on percentage alone but there are no other fees, and that swings it back in your favor - no monthly fees, batch fees, trans fees, tiers, and the dozen or so little cuts that acquirers take. I've seen bills that claimed to be 1.4% but were actually 4.1% after all those fees/gotchas were accounted for. PayPal Here is 2.7%. Really.

Another benefit of modern acquirers is they work via Bluetooth to phones or tablets, using the tablet to ring up the sale and accept the finger-signature. This also means they can use the unbelievably cheap cellular data network access for tablets specifically ($100/year is readily available) rather than paying for commercial internet service.

And they work anywhere, so if you have roving salesmen they can swipe Visa-MC at the customer. Instead of writing down numbers for the treasurer (a whole 'nother PCI-DSS nightmare), to say nothing of declined charges!

Card Not Present (CNP) transactions

Use modern keypad P2PE devices such as PayPal Here's big reader for CNP transactions. Don't enter CNP transactions on any kind of tablet or PC or you place the PC, network, yadayada into PCI-DSS.

Alternately, minimize or outlaw CNP transactions, and convert them to billing out through PayPal etc. (which comes with PayPal Here obviously). That way the consumer is using his own device to interact with PayPal etc., and that makes PCI-DSS their problem.