In South Africa there's this payment method called SiD which may be used to pay for things like flights. SiD is an assisted method where you fill in a third party form with your internet banking login details and they aid you in the online banking payment process by filling in certain numbers for you (amount, reference, etc).

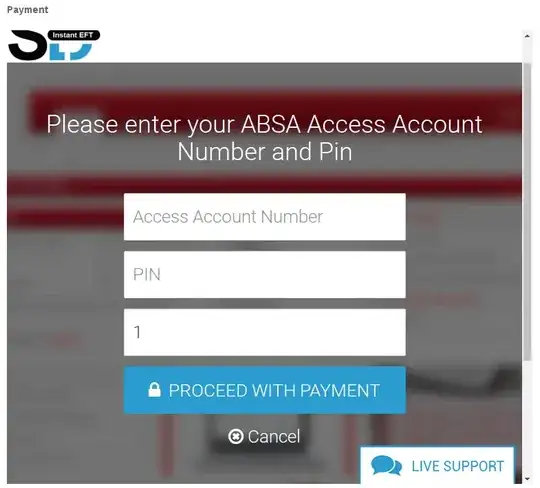

Here's what it looks like:

These are the login fields for my internet banking in a 3rd party form. The page in the background (the red) is recognised as my internet banking page.

On the help page, it says they don't store details but may store bank account number for refund purposes.

SID may store your bank account number for refund purposes. However, no third party can access or operate your Internet Banking facilities based on this information, or any other information retained by SID.

This is getting used in a number of places here as a payment option and my understanding is that to give my login details to a 3rd party is a very bad idea. They could easily store the numbers I put in their form and use them later.

Since this is becoming popular, is it possible that I'm just being paranoid. Is this method - supplying my login information to a 3rd party form - secure?