DAO

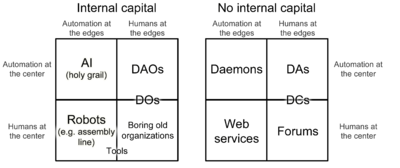

A Decentralized Autonomous Organization (often abbreviated "DAO"; sometimes referred to as a Fully Automated Business Entity or Distributed Autonomous Corporation, often abbreviated "FAB" or "DAC") is a decentralized network of narrow-AI autonomous agents which perform an output-maximizing production function and which divides its labor into computationally intractable tasks (which it incentivizes humans to do) and tasks which it performs itself.[1][2] It can be thought of as a corporation run without any human involvement under the control of an incorruptible set of business rules. These rules are typically implemented as publicly auditable open-source software distributed across the computers of their stakeholders. A human becomes a stakeholder by buying stock in the company or being paid in that stock to provide services for the company. This stock may entitle its owner to a share of the profits of the DAO, participation in its growth, and/or a say in how it is run.[3]

Terminology

Autonomous Agents

In an autonomous agent, there is no necessary specific human involvement outside of some degree of the human effort necessary to build the hardware that the agent runs on. Outside of that, there is no need for any humans to exist that are aware of the agent’s existence. One example of an autonomous agent that already exists today would be a computer virus; the virus survives by replicating itself from machine to machine without deliberate human action.[4]

Decentralized Applications

A smart contract is the simplest form of decentralized automation. It is a mechanism involving digital assets and two or more parties, where some or all of the parties put assets in and assets are automatically redistributed among those parties according to a formula based on certain data that is not known at the time the contract is initiated. A decentralized application is similar to a smart contract, but different in two key ways. First of all, a decentralized application has an unbounded number of participants on all sides of the market. Second, a decentralized application need not be necessarily financial.[4]

Decentralized Organizations

Decentralized Autonomous Organizations

Decentralized Autonomous Corporations

According to Stan Larimer, President of Invictus Innovations, Inc. (a developer of DACs), an open source DAC with its state information kept public has these characteristics:

- They are corporations – they are free and independent persons (but don’t have legal personality).

- They are autonomous – once up to speed, they no longer need (or heed) their creators.

- They are distributed – there are no central points of control or failure that can be attacked.

- They are transparent – their books and business rules are auditable by all.

- They are confidential – customer information is securely (and incorruptibly) protected.

- They are trustworthy – because no interaction with them depends on trust.

- They are fiduciaries – acting solely in their customers’ and shareholders’ interests.

- They are self-regulating – they robotically obey their own rules.

- They are incorruptible – no one can exercise seductive or coercive influence over them.

- They are sovereign – over their digital resources (but don't have legal capacity).[5]

Criticism of terminology

Some of those interested in new models for building successful and massively scalable applications reject the term, arguing that the classification reintroduces legacy hierarchy-based structures with their regulatory and compliance issues, unnecessarily burdening those involved in their development. For example, in their white paper The Emerging Wave of Decentralized Applications, David Johnston, et al., argue that the term "Distributed Autonomous Corporations" shouldn't be used:[3]

It is worth while to note that the authors of this paper agree with many of the concepts proposed by the Invictus authors and the spirit and ethics they [uphold] we embrace wholeheartedly. The point on which we disagree is one of property terminology, “Distributed” and “Autonomous” are great terms, we don’t believe “Corporation” in particular is a desirable term for these entities. One of our primary reservations with using the term is, “Corporation” carries a lot of historical and legal baggage that won’t necessarily best serve the community of developers and entrepreneurs seeking to describe and build these new projects. If you Google the definition of “Corporation” the result is: “a company or group of people authorized to act as a single entity (legally a person) and recognized as such in law.”

Economic Theory

In this economic theory, the role of the firm is played by the DAO, and the role of the entrepreneur is played by the programmers who develop the DAO.

The Firm

In its typical implementation as publicly auditable rules distributed across the computers of the stakeholders, the DAO can be thought of in a neoclassical sense as a production function or production possibilities set, a black box that transforms inputs into outputs. The DAO can be modeled as a single actor, facing a series of mathematical calculations, implicit in the non-self-verifying data, determined by the characteristics of the production function. The reason that the DAO can exist is because market coordination without it fails due to lack of necessary intersubjective points of orientation, that is, lack of so-called Schelling points. The emergence of behavior-coordinating Schelling points is a characteristic of the way that the DAO is coded.[6]

The Entrepreneur

The entrepreneurship of the DAO's development process can be thought of in a Schumpeterian sense as an exceptional occurrence of massive importance. The programmers who develop and launch the DAO are persons who by introducing "new combinations" shake the economy out of its previous equilibrium, starting a process Schumpeter termed creative destruction.[7] This speaks to the tenuous relationship between the developers and the DAO they own or contract with, because Schumpeterian entrepreneurship is sui generis (independent of its environment).[8]

Legal Issues

DAOs currently have no way to indemnify users since they lack legal personality and cash-flow, and have no assets. Accordingly, recovery in the event that a given DAO fails could turn out to be extremely difficult in practice. Consequently if for example, a DAO does have funds, they may be able to indemnify specific users (namely exchanges) through corporate insurance (a bond).[9] According to Austin Brister, a Houston-based attorney:

Consumer protection laws can be far reaching and quite unforgiving. Ordinary businesses do just fine in navigating these laws, even if they don't realize it, because they can adjust their interactions with consumers in "real-time" in order to be reasonable, well-centered, and act in good faith in dealing with consumers. However, the problem with smart contracts, decentralized autonomous organizations, and the like, is that they are hard-wired to act in one way, whether it makes sense or not.

Unforeseeable circumstances practically always present themselves to businesses of all types, and by definition, these circumstances cannot be foreseen or planned for. These systems need to adequately plan for this possibility, and be prepared to be properly insured or adequately bonded in the event things go wrong, and customers are hurt. Similarly, consumers should be aware that they are not dealing with living breathing people, but rather a machine subject only to 0's and 1's.[9]

Key architectural principles

- The Black Swan principle: Because of the impossibility of calculating the risks of consequential rare events and predicting their occurrence, an implementation must be based on nonpredictive decision-making under uncertainty, with more upside than downside from random events.

- The Chessmaster principle: In general, an implementation must treat people like pawns in a chess game, patiently moving them into places that often seem harmless or pointless, and getting them to do all the heavy computational lifting. The best implementations will have layers of misdirection and backup plans in case some hacker attempts to defraud them, for instance, causing the attacker to do some work for them in the attempt.

- The Finagle's Law principle: In general, an implementation of a DAO must assume that if there are two or more ways to do something, and one of those ways can result in a catastrophe for the DAO, then someone will choose it. The best implementations rely on low trust protocols and behavior-shaping constraints to protect themselves. (Being merely narrow AI, they cannot make nuanced trust judgments and are potentially easy to scam.)

Layers in the DAO protocol suite

The DAO protocol suite uses encapsulation to provide abstraction of protocols and services. Encapsulation is usually aligned with the division of the protocol suite into layers of general functionality. Viewing layers as providing or consuming a service is a method of abstraction to isolate Services Layer protocols from the details of generating addresses, for example, while the Memory Layer avoids having to know the details of each and every market interaction and its protocol.

Internetworking Layer

This layer provides a market-wide system of interconnected computer networks (the internet). This layer supports the peer-to-peer communications infrastructure that allows the DAO to be distributed and the other layers to interact.

Economic Layer

Technologies like Bitcoin have enabled this layer, which has the responsibility of maintaining a balance in some cryptographic money, and sending and receiving transactions. It handles non-self-verifying time data so that a transaction cannot spend money before that money was received and cannot spend money that has already been spent. Technologies like Mastercoin or Ripple provide the distributed, peer-to-peer payment system. This layer depends on the Internetworking layer.

This layer is composed of Type I and Type II decentralized applications, the payment systems being based on the cryptographic money systems with their existing blockchains, having independent protocols and tokens of their own.[3]

Memory Layer

This layer maintains persistent state information about the DAO. Generally, a blockchain is used to keep state information public. State information is kept private by using secure multiparty computation with the inputs split up using an algorithm called Shamir's Secret Sharing. This allows the DAO to decentrally:

- self-validate some of its own computation,

- correctly sign transactions, and

- generate addresses

This layer depends on the Internetworking layer.

Data Gathering Layer

This layer handles non-self-verifying data about the real world:

- Demand. Data about what people want.

- Supply. Data about what resources are available to obtain what people want.

This layer provides some kind of resource-democracy mechanism to vote on the correct value of some fact, and ensure that humans are incentivized to provide accurate estimates by depriving everyone whose report does not match the “mainstream view” of the monetary reward. This layer depends on the Economic layer and the Memory layer.

Self-modification Layer

This layer handles allowing humans to modify the DAO so as to future-proof it, e.g. changing APIs and source code. This layer allows DACs to improve themselves by purchasing the services of humans via bilateral hostage contracts, for instance.[10] This layer also allows the DAO to set an upper bound on the losses caused by any malicious collusion.[11] A/B testing can be used to determine if the delivered work is really better than the old one or not, and only releasing the payment if the results of the test are positive. Alternatively, a quorum of dispute mediators can be specified, and they decide if the contract was met or not. This layer depends on the Economic layer and the Memory layer.

Output Layer

This layer interacts with the world using multiparty-signed API requests in a decentralized way. This may include APIs that allow for renting server capacity and then remotely controlling that server, for example, or the ability to post human-readable contracts to freelancer forums or the Mechanical Turk. DACs can expose their services to humans (or other DACs) by selecting a name and then registering it with Namecoin. Using DNS hierarchies and Namecoin together allows interested parties to monitor for new agents coming online: the act of registering a name under a particular part of the tree automatically advertises its existence. This layer depends on the Economic layer, the Memory layer, and the Data Gathering layer.

This layer is composed of Type III Decentralized Applications, having their own independent protocols and tokens.[3]

Services Layer

This layer runs the artificial intelligence algorithm that the DAO relies on to detect patterns in real-world data and model it without human intervention. This allows the DAO to create sell-able value fast enough to keep up with its own resource demands in the marketplace of humans. This layer depends on the Economic layer, the Memory layer and the Data Gathering layer.

Hiring Employees

Making a fine-grained evaluation of an individual human employee is likely impossible. The best solution is likely to simply use monetary incentives to direct people’s actions on a coarse level, and then let the community self-organize to make the fine-grained adjustments. The extent to which a DAO targets a community for investment and participation, rather than discrete individuals, is the choice of its original developers.[12] On the one hand, targeting a community can allow your human support to work together to solve problems in large groups. On the other hand, keeping everyone separate prevents collusion, and in that way reduces the likelihood of a hostile takeover.[13]

Hostile Takeovers

A hostile takeover of a DAO handling money means that the attacker gains the ability to drain the DAO’s entire wallet. Countering hostile takeovers requires certain economic measures to establish consensus:

- Proof of work is used to deter denial of service attacks by requiring some work from the service requester that is moderately hard (but feasible) on the requester side but easy to check for the service provider. This is commonly referred to as "mining".[3]

- Proof of stake is used to deter other service abuses such as a Sybil attack.

Another counter-measure might simply be to allow the decentralized corporation to have shareholders, so that shareholders get some kind of special voting privileges, along with the right to a share of the profits, in exchange for investing. (Shareholders benefit if the price goes up, so shareholders are encouraged to do things that increase the price.) This would incentivize the shareholders to protect their investment.

Sybil Attacks

A hostile takeover could be accomplished by a successful Sybil attack, say through a botnet, overwhelming the resource-democracy mechanism by controlling over half of the servers in the network.

Requiring each participating node to show proof that it controls some moderately large amount of crypto-currency would prevent this kind of attack. Then implementing a hostile takeover would require more resources than all of the legitimate nodes committed together. The moderately large amount of crypto-currency could even be moved to a multisignature address partially controlled by the network as a surety bond, both discouraging nodes from cheating and giving their owners a great incentive to act and even get together to keep the corporation alive.

Applications

There are three major categories of industries where DACs will be able to survive on their own merits and provide genuine value to society: natural monopolies, illegal entities, and entities of extremely low profitability.

Natural Monopolies

Template:Example farm A natural monopoly is a monopoly in an industry in which it is most efficient (involving the lowest long-run average cost) for production to be concentrated in a single firm: software protocols, languages and to some extent social networks and currencies. A DAO can theoretically be designed so that no one involved in the price-setting mechanism has an incentive to fix prices over market rates. More generally, DACs can be made invulnerable to corruption in ways unimaginable in human-controlled system, although great care would certainly need to be taken not to introduce other vulnerabilities instead.[13]

- Crop insurance

- Identity Corp, a corporation whose sole purpose is to create cryptographically secure identity documents for individuals that they could sign messages with, and are linked to individuals’ physical identities.[14]

- Social network - Monetizable Diaspora

- StorJ, a simple drop-box style file service with pay per use via bitcoin (and perhaps with naming provided via namecoin and/or tor hidden services).[15] StorJ isn't smart enough to judge bad proposals on its own — instead it forms agreements that make it unprofitable to cheat.

- Weather network

- Bitcoin itself and all of Bitcoin forks/Altcurrencies

- Colored Coins are working on defining themselves as a DAO

- Mastercoin, a DAO replacement for Forex, Shares, and much more. Later evolved into a ProtoShares competitor.

- Mitosys - a DAC replacement for Bit-Message

- BitShares - a DAC industry with the purpose of providing infrastructure and software for other DACs. Currently available DACS within BitShares ecosystem:

- BitSharesX - a family of DACs that implement the business model of a bank and exchange.

- The Ripple protocol

- Wetube

- blackbox is a Bitcoin-enabled, decentralized cloud that uses TradeNet

Illegal Entities

Because of a combination of the DAO's incorruptible nature and the explosive growth in regulations, services that violate government laws and regulations are unavoidable. But their decentralized nature makes it extremely difficult to prevent them from taking over illegal markets. As Satoshi Nakamoto said, "Governments are good at cutting off the heads of a centrally controlled networks like Napster, but pure P2P networks like Gnutella and Tor seem to be holding their own".[16]

- Decentralized file-sharing networks for copyright infringement

- A captcha-cracker, that requires CPU. People pay for the Captchas to be cracked and the DAO provides some kind of API for people to offer their CPU and hosting of the software, if they do so, they get bitcoins. Putting this up online, with some marketing, the software should survive on its own as long as there are captchas that needs to be cracked.

Entities of Extremely Low Profitability

Finally, there are those cases where a decentralized network can simply maintain itself more efficiently and provides better services than any centralized alternative.

- The peer-to-peer network used by Blizzard to distribute updates to its massively multiplayer online game World of Warcraft

Examples in literature

- In Daniel Suarez's techno-thriller, Daemon, a collection of sophisticated computer programs have been left sitting passive on machines scatted around the Internet until one of them reads the programmer's obituary, which sends triggers to other systems which activate a number of other distributed processes, awakening the DAO.

See also

- Bitcoin protocol

- Decentralized computing

- Incentive-centered design

- Merkle tree

- Ripple

- Serious game

External links

- Bitcoin: A Peer-to-Peer Electronic Cash System

- Bitcoin Magazine: Bootstrapping a DAC

- Bootstrapping an Autonomous Decentralized Corporation Part 2: Interacting With The World

- Topic on bitsharestalk

- Ethereum: A Next-Generation Generalized Smart Contract and Decentralized Application Platform

- StorJ, and Bitcoin autonomous agents

- The Hidden Costs of Bitcoin

- Bitcoin and the Three Laws of Robotics

- DAC Revisited

- DACs That Spawn DACs?

- TV Tropes Analysis of Daemon

- Dagger is a proof of work algorithm intended to provide a memory-hard proof of work based on moderately connected directed acyclic graphs.

- Patricia Tree

- Great Chain of Numbers: A Guide to Smart Contracts, Smart Property and Trustless Asset Management

- Accelerating Bitcoin's Transaction Processing Fast Money Grows on Trees, Not Chains

- Mike Hearn's talk on autonomous agents, Turing Festival 2013

- Colored Coins

- Bitcoin-using autonomous agents

- Contracts

- List of Decentralized Autonomous Corporations

- Simplified payment verification

- Smart Property

- Distributed Production Network

- The Master Protocol / Mastercoin Complete Specification

References

Template:Reflist

- ↑ Babbitt, Dave. "Crypto-Economic Design: A Proposed Agent-Based Modeling Effort." SwarmFest 2014: 18th Annual Meeting on Agent-Based Modeling & Simulation, University of Notre Dame, McKenna Hall Auditorium, Notre Dame, IN USA, June 29 - July 1, 2014. Ed. Greg Madey & Ryan McCune. Tuesday 3:00 PM Address. Retrieved from http://www3.nd.edu/~swarm06/SwarmFest2014/Swarmfest2014McCune.pdf

- ↑ Template:Cite thesis

- 1 2 3 4 5 "The Emerging Wave of Decentralized Applications". GitHub. Retrieved 2 July 2014.

- 1 2 Template:Cite web

- ↑ Larimer, Stan. "Bitcoin and the Three Laws of Robotics". Let's Talk Bitcoin. Retrieved 2 July 2014.

- ↑ Malmgren, H. B. (1961). "Information, Expectations and the Theory of the Firm". Quarterly Journal of Economics 75: 399-421.

- ↑ Becker, Marcus C.; Thorbjørn Knudsen (2003). "The Entrepreneur at a Crucial Juncture in Schumpeter’s Work: Schumpeter’s 1928 Handbook Entry Entrepreneur". Advances in Austrian Economics 6: 199–234.

- ↑ Foss, Nicolai J. (2012). Organizing Entrepreneurial Judgment. Cambridge University Press.

- 1 2 Template:Cite web

- ↑ Andreev, Oleg. "Contracts without trust or third parties". Personal Blog. Retrieved 2 July 2014.

- ↑ DeFigueiredo, Dimitri do B. "TrustDavis: A Non-Exploitable Online Reputation System". Department of Computer Science, University of California at Davis. Retrieved 2 July 2014.

- ↑ Template:Cite AV media

- 1 2 Buterin, Vitalik. "Bootstrapping An Autonomous Decentralized Corporation, Part 2: Interacting With the World". Bitcoin Magazine™. Coin Publishing Ltd. Retrieved 22 November 2013.

- ↑ Buterin, Vitalik. "Bootstrapping a Decentralized Autonomous Corporation, Part 3: Identity Corp". Bitcoin Magazine™. Coin Publishing Ltd. Retrieved 23 November 2013.

- ↑ Garzik, Jeff. "StorJ, and Bitcoin autonomous agents". Random blatherings by Jeff. Blogger. Retrieved 22 November 2013.

- ↑ "The root of the problem!".