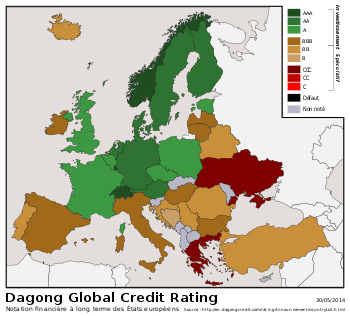

Dagong Global Credit Rating

Dagong Global Credit Rating (Chinese: 大公国际资信评估有限公司; pinyin: Dàgōng Guójì Zīxìn Pínggū Yǒuxiàn Gōngsī) is a credit rating agency based in China.

| Industry | Financial Services |

|---|---|

| Founded | 1994 |

| Headquarters | , China |

Key people | Guan Jianzhong (Chairman) |

| Website | dagongcredit.com |

History

The company was established in 1994, following approval by the People's Bank of China and the State Economic and Trade Division of the People's Republic of China.

In May 2009, an agreement of mutual cooperation was signed with Xinhua news agency, reported as "promoting a national credit rating system".[1]

In June 2013, Dagong Europe Credit Rating was registered and received authorisation from the European Securities and Markets Authority as Credit Rating Agency. In the same year, it was recognised by the Joint Committee of the three European Supervisory Authorities (EBA, ESMA and EIOPA) as External Credit Assessment Institution operating in the European Union.[2]

In July 2014, Dagong Global Credit Rating (Hong Kong) Co., Limited was granted a Type 10 License (Providing Credit Rating Services) by the Securities and Futures Commission of Hong Kong.

In 2018, Dagong's operations were suspended following accusation of corruption and doctored ratings in exchange for hefty fees.[3] In 2019, China Reform Holdings Corp. Ltd. (a state-controlled company) was brought on board to help re-organise the business.[4]

Long-term credit ratings

Dagong rates borrowers on a scale from AAA to C. Intermediate ratings are offered at each level between AA and CC (e.g., AA+, AA, and AA-).[5]

- AAA: Highest credit rating

- AA: Very High credit rating

- A: High credit rating

- BBB: Medium credit rating

- BB: Low medium credit rating

- B: Relatively low credit rating

- CCC: Low credit rating

- CC: Very low credit rating.

- C: Lowest credit rating. Issuer is unable to meet financial obligations and possibly in the process of bankruptcy.

Short-term credit ratings

Debt with maturity dates of 1 year or shorter are rated on a scale from A-1 to D. No intermediate ratings (e.g., B+ and B-) are used.[5]

- A-1: Highest credit rating

- A-2: Good credit rating

- A-3: Fair credit rating

- B: Significant speculative credit rating

- C: High default risk credit rating

- D: Default

References

- http://news.xinhuanet.com/politics/2009-05/21/content_11414709.htm (Chinese) 新华社与大公国际签署合作框架协议

- http://www.dagongeurope.com/about_us.php

- https://www.scmp.com/news/china/economy/article/2160313/chinese-credit-rating-agency-dagong-suspended-after-cash-ratings

- https://www.caixinglobal.com/2019-04-18/state-firm-takes-over-disgraced-credit-rating-agency-dagong-101406014.html

- "Symbols and Definition of Dagong's Credit Rating Scale" (PDF). Dagong Global Credit Rating Co. Archived from the original (pdf) on 3 July 2011. Retrieved 9 February 2011.