Welsh fiscal deficit

The Welsh fiscal deficit is the gap between government spending in Wales and local tax revenue. For the 2018–19 fiscal year, it is estimated at around £13.7 billion, which is 19.4 percent of GDP and about £4,300 per capita.

Deficit

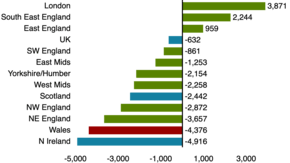

Nine of the twelve UK statistical regions (the exceptions are London, South East England and East of England) carry a deficit. At £4,300, Wales's fiscal deficit per capita is the highest of the regions except for Northern Ireland fiscal deficit, which is nearly £5,000 per capita.[1][2] Tax revenue per capita in Wales is only 76 percent as much as the UK average, but spending is 108 percent as much, leading to shortfall. Wales spends more on social security than other parts of the UK but significantly less on infrastructure and scientific research.[3]

In 2016, Wales spent £14.7 billion more than it gathered in local revenue, which decreased to £13.7 billion for the 2018–19 fiscal year, due to reduction in public spending (which peaked in 2011–12).[4][2] For the 2018–19 fiscal year, the fiscal deficit is about 19.4 percent of Wales's estimated GDP, compared to 2 percent for the United Kingdom as a whole.[3]

Implications

Wales spends 11 percent more per person than England. Welsh economist Ed Gareth Poole notes that fiscal transfers between wealthier and poorer parts of a sovereign state are not unusual.[3] Wales's government deficit was consistently higher than that of Greece during the Greek government-debt crisis[5][6] but, unlike Greece, the gap was covered by transfer payments from the rest of the UK. Such transfer payments, according to the economist Robert A. Mundell, are essential to a functional currency union.[7]

The fiscal deficit has implications for hypothetical Welsh independence. The Welsh economist John Ball suggests that an independent Welsh government could plug the budget shortfall by instituting land value tax, tourist tax, or other new taxes. In his opinion, VAT revenues from businesses not owned by Welsh residents are underestimated in the current revenue data, meaning that the shortfall may not be as high as it appears.[8][9]

References

- Birnie, Esmond (18 February 2020). "Scrutinising Northern Ireland's sizeable fiscal deficit is interesting". Belfast Telegraph. Retrieved 23 April 2020.

- Rutter, Calum (2 August 2019). "Welsh spending cuts cause deficit reduction, says study". Public Finance. Retrieved 23 April 2020.

- "Shortfall in public finances in Wales due to lower revenues, report finds". Cardiff University. 2 July 2019. Retrieved 23 April 2020.

- Dickins, Sarah (29 July 2019). "Tax and public spending gap narrows in Wales". BBC News. Retrieved 23 April 2020.

- Kindreich, Adam (20 July 2017). "The Greek Financial Crisis (2009–2016)". Financial Scandals, Scoundrels & Crises. Exhibit 2. Retrieved 23 April 2020.CS1 maint: location (link)

- Government Expenditure and Revenue Wales 2019 (PDF) (Report). Wales Fiscal Analysis (Cardiff University). 2019. p. 9.

- Thomas, Landon (27 January 2012). "The Welsh Economy Slips, but London Cushions the Fall". The New York Times. Retrieved 23 April 2020.

- Ball, John (25 January 2019). "Is Wales really too poor to be independent?". Institute of Welsh Affairs. Retrieved 23 April 2020.

- Ball, Dr John (5 July 2019). "Does Wales have the tax base to make independence viable?". birminghampost. Retrieved 23 April 2020.