The Intelligent Investor

The Intelligent Investor by Benjamin Graham, first published in 1949, is a widely acclaimed book on value investing.

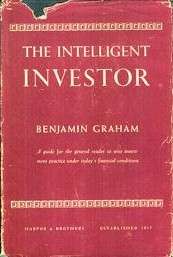

First edition | |

| Author | Benjamin Graham |

|---|---|

| Cover artist | Donavan Hayes |

| Country | United States |

| Language | English |

| Subject | Securities, Investment |

| Publisher | Harper & Brothers |

Publication date | 1949 |

| Pages | 640 |

| ISBN | 0-06-055566-1 (2008 edition) |

| OCLC | 1723191 |

| LC Class | HG4521 .G665 |

Background and history

The Intelligent Investor is based on value investing, an investment approach Graham began teaching at Columbia Business School in 1928 and subsequently refined with David Dodd.[1] This sentiment was echoed by other Graham disciples such as Irving Kahn and Walter Schloss.

The Intelligent Investor also marks a significant deviation to stock selection from Graham's earlier works, such as Security Analysis. He explained the change as:

The thing that I have been emphasizing in my own work for the last few years has been the group approach. To try to buy groups of stocks that meet some simple criterion for being undervalued -- regardless of the industry and with very little attention to the individual company... I found the results were very good for 50 years. They certainly did twice as well as the Dow Jones. And so my enthusiasm has been transferred from the selective to the group approach.[2]

Mr. Market

Graham's favorite allegory is that of Mr. Market, meant to personify the irrationality and group-think of the stock market. Mr. Market is an obliging fellow who turns up every day at the shareholder's door offering to buy or sell his shares at a different price. Often, the price quoted by Mr. Market seems plausible, but sometimes it is ridiculous. The investor is free to either agree with his quoted price and trade with him, or ignore him completely. Mr. Market doesn't mind this, and will be back the following day to quote another price.

The point of this anecdote is that the investor should not regard the whims of Mr. Market as a determining factor in the value of the shares the investor owns. He should profit from market folly rather than participate in it. The investor is advised to concentrate on the real life performance of his companies and receiving dividends, rather than be too concerned with Mr. Market's often irrational behavior.

Editions

Since the work was published in 1949 Graham revised it several times, most recently in 1971–72. This was published in 1973 as the "Fourth Revised Edition" ISBN 0-06-015547-7, and it included a preface and appendices by Warren Buffett. Graham died in 1976. Commentaries and new footnotes were added to the fourth edition by Jason Zweig, and this new revision was published in 2003.[3]

- The Intelligent Investor (Re-issue of the 1949 edition) by Benjamin Graham. Collins, 2005, 269 pages. ISBN 0-06-075261-0.

- The Intelligent Investor by Benjamin Graham, 1949, 1954, 1959, 1965(Library of Congress Catalog Card Number 64-7552) by Harper & Row Publishers Inc, New York.

- The Intelligent Investor (Revised 1973 edition) by Benjamin Graham and Jason Zweig. HarperBusiness Essentials, 2003, 640 pages. ISBN 0-06-055566-1.

An unabridged audio version of the Revised Edition of The Intelligent Investor was also released on July 7, 2015.[4]

Book contents

2003 edition

- Introduction: What This Book Expects to Accomplish

- Commentary on the Introduction

- Investment versus Speculation: Results to Be Expected by the Intelligent Investor

- The Investor and Inflation

- A Century of Stock Market History: The Level of Stock Market Prices in Early 1972

- General Portfolio Policy: The Defensive Investor

- The Defensive Investor and Common Stocks

- Portfolio Policy for the Enterprising Investor: Negative Approach

- Portfolio Policy for the Enterprising Investor: The Positive Side

- The Investor and Market Fluctuations

- Investing in Investment Funds

- The Investor and His Advisers

- Security Analysis for the Lay Investor: General Approach

- Things to Consider About Per-Share Earnings

- A Comparison of Four Listed Companies

- Stock Selection for the Defensive Investor

- Stock Selection for the Enterprising Investor

- Convertible Issues and Warrants

- Four Extremely Instructive Case Histories and more

- A Comparison of Eight Pairs of Companies

- Shareholders and Managements: Dividend Policy

- "Margin of Safety" as the Central Concept of Investment

- Postscript

- Commentary on Postscript

- Appendixes

- The Superinvestors of Graham-and-Doddsville

- Important Rules Concerning Taxability of Investment Income and Security Transactions (in 1972)

- The Basics of Investment Taxation (Updated as of 2003)

- The New Speculation in Common Stocks

- A Case History: Aetna Maintenance Co.

- Tax Accounting for NVF's Acquisition of Sharon Steel Shares

- Technological Companies as Investments

- Endnotes

- Index

References

- Graham, Benjamin; Jason Zweig (2003-07-08) [1949]. The Intelligent Investor. Warren E. Buffett (collaborator) (2003 ed.). HarperCollins. front cover. ISBN 0-06-055566-1.

- "An hour with Mr. Graham: "Imagine – there seems to be practically a foolproof way of getting good results out of common stock investment…"". 19 February 2013.

- Graham, Benjamin; Jason Zweig (2003-07-08) [1949]. The Intelligent Investor. Warren Buffett (collaborator) (2003 ed.). HarperCollins. p. vii. ISBN 0-06-055566-1.

- The Intelligent Investor Rev Ed – via www.audible.com.

Further reading

- Williams, John Burr. The Theory of Investment Value.