Russian National Wealth Fund

The Russian National Wealth Fund is Russia's sovereign wealth fund. It was created after the Stabilization Fund of the Russian Federation was split into two separate investment funds on 30 January 2008.

| Sovereign wealth fund | |

| Founded | 2008 |

| Total assets | $176.64 bn (August 2020) |

| Website | old |

Fund structure

The two funds are the Reserve Fund, which is invested abroad in low-yield securities and used when oil and gas incomes fall, and the National Wealth Fund, which invests in riskier, higher return vehicles, as well as federal budget expenditures. The Reserve Fund was given $125 billion and the National Wealth Fund was given $32 billion. The fund is controlled by the Ministry of Finance. One of the fund's main responsibilities is to support the Russian pension system.[1]

Overview

The National Wealth Fund will receive funds from investment returns or any excess funds that the Reserve Fund produces. The Reserve Fund is capped at 10% of Russian GDP, and any funds over that will be given to the Wealth Fund. The fund also has accumulated $72.71bn (as of 1 September 2016) from taxes and duties it collects on the production and export of oil and gas.[1]

According to the Russian Ministry of Finance, the foreign debt securities the fund can invest in must have ratings of AA- or higher by Fitch or Standard & Poor's, or a rating of Aa3 by Moody's.[1] Despite this, the fund agreed to buy (on 17 December 2013) $15 billion of Ukrainian Eurobonds, despite the fact that Ukraine had lower credit ratings at the time.[1][2][3]

The fund stands out from other global funds with it gathering investments into the national economy itself instead investing everything overseas, so it can provide a boost to the slow modernisation of Russian infrastructure in a time of otherwise anaemic investment. Other countries like Indonesia are following the Russian example in running a National Wealth Fund it is reported in 2020.[1][4]

The Russian National Wealth Fund was merged in 2017 with the remaining of Russia’s sovereign Reserve Fund. The Reserve fund was built up over years with profits from oil exports but amid low oil price prices was emptied by the end of 2017 and ceased to exist.

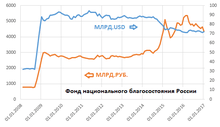

Size of the fund and historic numbers

Source by the Ministry of Finance of Russia:[5]

| Date | millions of $ | millions of ₽ |

| 01.02.2008 | 32,000 | 783,310 |

| 01.03.2008 | 32,220 | 777,030 |

| 01.04.2008 | 32,900 | 773,570 |

| 01.05.2008 | 32,720 | 773,820 |

| 01.06.2008 | 32,600 | 773,930 |

| 01.07.2008 | 32,850 | 770,560 |

| 01.08.2008 | 32,690 | 766,480 |

| 01.09.2008 | 31,920 | 784,510 |

| 01.10.2008 | 48,680 | 1 228,880 |

| 01.11.2008 | 62,820 | 1 667,480 |

| 01.12.2008 | 76,380 | 2 108,460 |

| 01.01.2009 | 87,970 | 2 584,490 |

| 01.02.2009 | 84,470 | 2 991,500 |

| 01.03.2009 | 83,860 | 2 995,510 |

| 01.04.2009 | 85,710 | 2 915,210 |

| 01.05.2009 | 86,300 | 2 869,440 |

| 01.06.2009 | 89,860 | 2 784,140 |

| 01.07.2009 | 89,930 | 2 813,940 |

| 01.08.2009 | 90,020 | 2 858,700 |

| 01.09.2009 | 90,690 | 2 863,080 |

| 01.10.2009 | 91,860 | 2 764,370 |

| 01.11.2009 | 93,380 | 2 712,560 |

| 01.12.2009 | 92,890 | 2 769,84 |

| 01.01.2010 | 91,560 | 2 769,020 |

| 01.02.2010 | 90,630 | 2 757,890 |

| 01.03.2010 | 89,630 | 2 684,210 |

| 01.04.2010 | 89,580 | 2 630,270 |

| 01.05.2010 | 88,830 | 2 601,620 |

| 01.06.2010 | 85,800 | 2 616,540 |

| 01.07.2010 | 85,470 | 2 666,410 |

| 01.08.2010 | 88,240 | 2 663,760 |

| 01.09.2010 | 87,120 | 2 671,540 |

| 01.10.2010 | 89,540 | 2 722,150 |

| 01.11.2010 | 90,080 | 2 772,800 |

| 01.12.2010 | 88,220 | 2 761,960 |

| 01.01.2011 | 88,440 | 2 695,520 |

| 01.02.2011 | 90,150 | 2 674,530 |

| 01.03.2011 | 90,940 | 2 631,980 |

| 01.04.2011 | 91,800 | 2 609,660 |

| 01.05.2011 | 94,340 | 2 594,580 |

| 01.06.2011 | 92,540 | 2 597,550 |

| 01.07.2011 | 92,610 | 2 600,000 |

| 01.08.2011 | 92,700 | 2 566,040 |

| 01.09.2011 | 92,630 | 2 673,050 |

| 01.10.2011 | 88,690 | 2 827,100 |

| 01.11.2011 | 91,190 | 2 726,420 |

| 01.12.2011 | 88,260 | 2 764,400 |

| 01.01.2012 | 86,790 | 2 794,430 |

| 01.02.2012 | 88,330 | 2 682,210 |

| 01.03.2012 | 89,840 | 2 600,880 |

| 01.04.2012 | 89,500 | 2 624,780 |

| 01.05.2012 | 89,210 | 2 619,520 |

| 01.06.2012 | 85,480 | 2 773,780 |

| 01.07.2012 | 85,640 | 2 810,450 |

| 01.08.2012 | 85,210 | 2 742,850 |

| 01.09.2012 | 85,850 | 2 772,450 |

| 01.10.2012 | 87,610 | 2 708,580 |

| 01.11.2012 | 87,190 | 2 748,670 |

| 01.12.2012 | 87,470 | 2 716,610 |

| 01.01.2013 | 88,590 | 2 690,630 |

| 01.02.2013 | 89,210 | 2 678,630 |

| 01.03.2013 | 87,610 | 2 682,580 |

| 01.04.2013 | 86,760 | 2 696,730 |

| 01.05.2013 | 87,270 | 2 727,790 |

| 01.06.2013 | 86,720 | 2 739,330 |

| 01.07.2013 | 86,470 | 2 828,230 |

| 01.08.2013 | 86,900 | 2 858,040 |

| 01.09.2013 | 86,770 | 2 884,790 |

| 01.10.2013 | 88,030 | 2 847,350 |

| 01.11.2013 | 88,740 | 2 845,190 |

| 01.12.2013 | 88,060 | 2 922,790 |

| 01.01.2014 | 88,630 | 2 900,640 |

| 01.02.2014 | 87,390 | 3 079,940 |

| 01.03.2014 | 87,250 | 3 145,340 |

| 01.04.2014 | 87,500 | 3 122,510 |

| 01.05.2014 | 87,620 | 3 127,940 |

| 01.06.2014 | 87,320 | 3 033,170 |

| 01.07.2014 | 87,940 | 2 957,380 |

| 01.08.2014 | 86,460 | 3 088,790 |

| 01.09.2014 | 85,310 | 3 150,500 |

| 01.10.2014 | 83,200 | 3 276,790 |

| 01.11.2014 | 81,740 | 3 547,020 |

| 01.12.2014 | 79,970 | 3 994,120 |

| 01.01.2015 | 78,000 | 4 388,090 |

| 01.02.2015 | 74,020 | 5 101,830 |

| 01.03.2015 | 74,920 | 4 590,590 |

| 01.04.2015 | 74,350 | 4 346,940 |

| 01.05.2015 | 76,330 | 3 946,420 |

| 01.06.2015 | 75,860 | 4 018,510 |

| 01.07.2015 | 75,650 | 4 200,530 |

| 01.08.2015 | 74,560 | 4 398,150 |

| 01.09.2015 | 73,760 | 4 903,670 |

| 01.10.2015 | 73,660 | 4 878,800 |

| 01.11.2015 | 73,450 | 4 728,390 |

| 01.12.2015 | 72,220 | 4 784,050 |

| 01.01.2016 | 71,720 | 5 227,180 |

| 01.02.2016 | 71,150 | 5 348,660 |

| 01.03.2016 | 71,340 | 5 356,960 |

| 01.04.2016 | 73,180 | 4 947,330 |

| 01.05.2016 | 73,860 | 4 751,690 |

| 01.06.2016 | 72,990 | 4 823,190 |

| 01.07.2016 | 72,760 | 4 675,360 |

| 01.08.2016 | 72,210 | 4 842,000 |

| 01.09.2016 | 72,710 | 4 719,170 |

| 01.10.2016 | 72,710 | 4 617,54 |

| 01.11.2016 | 72,200 | 4 541,930 |

| 01.12.2016 | 71,260 | 4 628,090 |

| 01.01.2017 | 71,870 | 4 359,160 |

| 01.02.2017 | 72,460 | 4 359,300 |

| 01.03.2017 | 72,600 | 4 206,380 |

| 01.04.2017 | 73,330 | 4 134,270 |

| 01.05.2017 | 73,570 | 4 192,500 |

| 01.06.2017 | 74,180 | 4 192,300 |

| 01.07.2017 | 74,220 | 4 385,490 |

| 01.08.2017 | 74,720 | 4 449,350 |

| 01.09.2017 | 75,360 | 4 425,350 |

| 01.10.2017 | 72,570 | 4 210,360 |

| 01.11.2017 | 69,360 | 4 130,810 |

| 01.12.2017 | 66,940 | 3 904,760 |

| 01.01.2018 | 65,150 | 3 752,940 |

| 01.02.2018 | 66,260 | 3 729,710 |

| 01.03.2018 | 66,440 | 3 698,960 |

| 01.04.2018 | 65,880 | 3 772,890 |

| 01.05.2018 | 63,910 | 3 962,700 |

| 01.06.2018 | 62,750 | 3 927,580 |

| 01.07.2018 | 77,110 | 4 839,260 |

| 01.08.2018 | 77,160 | 4 844,380 |

| 01.09.2018 | 75,790 | 5 160,280 |

| 01.10.2018 | 76,200 | 5 004,490 |

| 01.11.2018 | 75,590 | 4 972,440 |

| 01.12.2018 | 68,550 | 4 567,740 |

| 01.01.2019 | 58,100 | 4 036,050 |

| 01.02.2019 | 59,050 | 3 903,000 |

| 01.03.2019 | 59,120 | 3 888,000 |

| 01.04.2019 | 59,140 | 3 828,250 |

| 01.05.2019 | 58,960 | 3 814,440 |

| 01.06.2019 | 58,740 | 3 821,720 |

| 01.07.2019 | 59,660 | 3 762,960 |

| 01.08.2019 | 124,140 | 7 867,700 |

| 01.09.2019 | 122,880 | 8 170,490 |

| 01.10.2019 | 123,070 | 7 927,690 |

| 01.11.2019 | 124,460 | 7 949,610 |

| 01.12.2019 | 124,000 | 7 946,220 |

| 01.01.2020 | 125,56 | 7 773,06 |

| 01.02.2020 | 124,38 | 7 840,55 |

| 01.03.2020 | 123,4 | 8 249,59 |

| 01.04.2020 | 165,3 | 12 855,75 |

References

- Ukraine bailout could derail Putin's drive to boost Russian economy, Financial Times (18 December 2013)

- Russia cuts Ukraine gas price by a third, BBC News (17 December 2013)

- Ukraine to issue Eurobonds; Russia will purchase $15 bln, says Russian finance minister, Interfax-Ukraine (17 December 2013)

- "Indonesia to create sovereign wealth fund based on Russian model". Retrieved 14 May 2020.

- "Ministry of Finance Russia, STATISTICS". Retrieved 25 December 2019.