Moral suasion

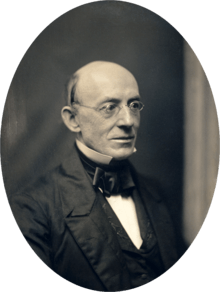

Moral suasion is an appeal to morality in order to influence or change behavior. A famous example is the attempt by William Lloyd Garrison and his American Anti-Slavery Society to end slavery in the United States by using moral suasion.[1] In economics, moral suasion is more specifically defined as "the attempt to coerce private economic activity via governmental exhortation in directions not already defined or dictated by existing statute law".[2] The 'moral' aspect comes from the pressure for 'moral responsibility' to operate in a way that is consistent with furthering the good of the economy.[3] Moral suasion in this narrower sense is also sometimes known as jawboning.[4]

There are two types of moral suasion:

- "Pure" moral suasion is an appeal for altruistic behaviour[2] and is rarely used in economic policy

- "Impure" moral suasion, which is the usual meaning of "moral suasion" in economics, is backed by explicit or implicit threats by authorities in order to provide incentives to comply with the authorities' wishes[2]

Pure moral suasion

Moral suasion has been applied in many different fields. In early educational thought, it was often paired against corporal punishment as a means of achieving school discipline.[6] Similarly, in parenting, writers from the 19th century through Benjamin Spock have advocated the use of moral suasion with children as an alternative to physical violence.[7] In politics, moral suasion has frequently been employed by movements for social change, but its effectiveness has varied widely.

Examples

Temperance movement

In the temperance movement of the 18th and early 19th centuries in Britain and North America, moral suasion was initially a key part of the strategy for reducing the prevalence of alcohol in society.[8] As the movement began to face the limitations of this strategy in the late 19th century, its members turned to legal coercion, leading to the rise of prohibitionism.[8]

United States civil rights movement

In the American Civil Rights Movement of the twentieth century, moral suasion was one of three major prongs of the movement, the others being legal action and collective nonviolent protest.[9] After initial victories, this nonviolent strategy began to struggle in the 1960s, and largely ended with the assassination of Martin Luther King, Jr..[10]

Promoting religious tolerance

Moral suasion has sometimes been effective in resolving religious disharmony, especially if the Government is actively involved as a mediator. Moral suasion has been effective in Singapore in the creation of religious harmony among different religious groups. When conflicts do arise, the Government of Singapore's approach is to mediate or resolve the issue through common sense, and moral suasion using the collective efforts of the community, grassroots and religious leaders.[11]

Protecting the environment

Usage of moral suasion in environment regulation consists in making polluters feel responsible for the negative externalities that they cause.[12] Moral suasion can be very efficient from an economic standpoint since economic agents are free to use any cost-minimising solution deal with their negative externalities instead of having to rely on a government-prescribed regulation or tax. Furthermore, the administrative costs of using moral suasion to deal with environmental problems is very low.[12]

A study of marine debris regulations in the United States from 1989 to 1993 revealed that moral suasion can be an effective tool to limit the discharge of trash into water in spite the offenders' low probability of being detected.[13] The evidence on the effectiveness of moral suasion methods to induce environmentally desirable behaviour, however, is not strong[13] unless it is coupled with other instruments. For example, Canadian policymakers advocates for moral suasion in their endeavour to achieve environmental and wildlife policy objectives, a course of action likely to fail if little regard is placed on the accompanying incentives.[14]

Impure moral suasion

As a policy tool, impure moral suasion differs from direct suasion using laws and regulations in that penalties for non-compliance are not systematically assessed on non-compliers.[2] This has led some authors to criticise moral suasion as immoral, since compliers get penalised for cooperating with the stated government agenda (thus incurring extra costs) while non-compliers are not punished.[2] Other objections to the use of moral suasion include the fact that it constitutes extra-legal coercion by the government, that it adds uncertainty to the regulatory process, and that it can undermine or delay the implementation of effective legislation.[2]

Effectiveness

Moral suasion will be "an effective economic policy whenever the expected costs of noncompliance is made to exceed the cost of compliance".[16]

There are 2 necessary conditions for this to happen.

- First, citizens must support the Government's policy,[16] thus entailing objective congruence between the promoter of moral suasion and the target whose behaviour should be changed. That support emanates from such factors that determine compliance as; potential illegal gain; severity and certainty of sanctions; individual's moral development and their standards of personal morality; individual's perceptions of how just and moral are rules being enforced; and social environmental influences.[13] For example, during the hyper-inflation in Zimbabwe, most business people were accepting foreign currency as a medium of exchange in violation of the country's Exchange Control rules and regulations despite calls by the Central Bank to persuade stakeholders to accept only the local currency as medium of exchange. The business community felt that the rules being enforced through moral suasion were not just and moral. Thus in cases where factors that determine compliance are in line with Government's objectives, the cost of non-compliance increases as behaviours which are contrary to social moral values suffer social reputation if members know about the non compliance.[13]

- Second, the population of economic agent to be persuaded must be small.[2] Fewness entails the easy identification of economic agents to persuade, and increase the perceived likelihood that non-compliers will be identified and punished.[2]

Even when those two necessary conditions are not fully met, moral suasion, if only partially effective, can be a valid choice of policy instruments if the alternatives are doing nothing or taking actions with high opportunity or administrative costs.[2]

Although neither a necessary nor a sufficient condition, a low level of competition amongst suppliers in the economy contributes to increased effectiveness of moral suasion. Indeed, companies that have been "persuaded" to adopt morally superior but more costly behaviour, will be less competitive and could be driven out of the market by competitors who are not fettered by such constraints if competition is too fierce.[17]

Examples

Regulating the financial sector

The Bank of Canada defines moral suasion in central banking as "a wide range of possible initiatives by the central bank designed to enlist the co-operation of commercial banks or of other financial organisations in pursuit of some objective of financial policy".[18] It could also be defined more generally as "a process whereby commercial banks co-operate with the central bank either for altruistic reasons or out of fear of administrative or legislative sanctions".[19]

Formal moral suasion is characterised by explicit (though non-contractual) commitments to "refrain from activities judged to be in conflict with policies of the central bank".[18] Informal moral suasion is more difficult to define and is carried through various conversations and interactions between the central bank and the commercial financial institutions, during which commercial institutions can be made to understand the central bank's policy objectives on various matters.

The oligopolistic competition in the British banking sector has witnessed the success of moral suasion as a monetary policy instrument, allowing the central bank to control by persuasion and directive.[18] Given that only five major banks need to be persuaded in England, a moral suasion policy instrument is very effective because non-compliers can be immediately identified and held up for censure, while in the United States where there are many commercial banks, the Federal Reserve needs to use legalistic controls to pursue the same ends.[2]

Curbing inflation

Moral suasion has been effectively used in the management of inflation in a number of countries and is also referred to as "open mouth operations" in the financial sector.[20] The common factor for the success of moral suasion is the trust that stakeholders have on the Central Bank. For example, New Zealand has experienced high inflation in the early and mid eighties which however drastically reduced as the bank managed to anchor stakeholder inflation expectation through moral suasion. Monetary policy to a great extent is the management of expectations,[21] influencing inflation expectations of business and labour. Researchers have found that inflation expectations greatly influence future inflation, hence the use of moral suasion to anchor inflation expectations has been an important instrument in reducing New Zealand's inflation rate.[22]

Moral suasion has also been widely and successfully used to curb moderate price increases in countries as Great Britain and Sweden where a principle of "democratic socialism" has been in place for some time.[23] Wage and price increases were agreed upon by the Government, Labour and businesses. The public ownership of the whole exercise enhanced compliance.[23]

In different political regimes

Although moral suasion can theoretically be used in any political regime, it has a higher chance of being effective in cases where the political authority is centralised and effective.

Centralisation of authority contributes to the effectiveness of moral suasion as a policy tool since it makes the government's positions clearer and more consistent. Attempts by governments to influence the behaviour of companies and citizens can therefore be understood more clearly.

Effectiveness of authority refers to the ease in which the intentions of the political executive can be transformed into legislative or regulatory action. This is important because the governments and agencies can use implied threats of price controls, additional regulation or taxation to induce certain behaviours from companies. Such threats will only have credibility if companies think that these threats will be carried out if they do not comply.

As fewness of economic agents to be persuaded is a necessary condition for moral suasion to be effective, this policy instrument is more adapted to countries with a higher concentration of suppliers, both in terms of number and of geography.

Studies suggest that moral suasion is usually not effective in environmental matters in advanced economies. It can, however, still be used for developing countries since there are still easy environmental gains that could be made without heavy-handed regulation.[2]

Interaction with other policy instruments

Moral suasion is rarely used in isolation.[2] Governments can use moral suasion in conjunction with a variety of other policy instruments to reach its objectives.

Regulation

Firms may alter their behaviour in order to reduce the probability that they will be subject to additional regulations. In fact, they may respond more to the threat of being regulated than to the actual imposition of regulations, as illustrated by the fact that US oil companies froze wholesale petrol prices when the 1991 Iraq war started, even without being prompted to do so.[24]

Price cap

Governments can also implicitly or explicitly threaten to establish price caps to make moral suasion more likely to succeed. This was illustrated in 1979 when the Chairman of the US Federal Reserve System, Paul Volcker, warned banks against raising prime rates above a certain level,[24] and in the 1960s when US President John F. Kennedy caused U.S. Steel to reverse its decision to increase prices by sharply criticizing the company.[25]

Additional taxation

Moral suasion, in the form of public exhortation, was used to curb the bonuses paid to certain employees in the financial sector, without much success.[26] The threat of additional, specific taxes[27] was later used in conjunction with moral suasion to make compliance more likely.

Open market transactions and other interventions by central banks

Central banks and governments who let markets know what they consider ranges of "appropriate" values for its currency has impacts on the trading of the currency, even if intervention never occurs.[28] Central banks can buy or sell various securities if the currency value falls outside its desired range.

Information provision

Governments can choose to publish information in order to "shame" certain market participants into altering their behaviour. The threat of information provision, and of shaming drug companies that were charging "excessive" prices in the eyes of the US government, was used by the Clinton administration to curb increases in drug prices.[28] The government of Singapore's decision to publish comparative cost data from different hospital to encourage them to be more efficient is also an example of where moral suasion was used in conjunction with information provision.[29]

Service provision

The threat of a public option, i.e. direct government provision of goods and services in a sector that is deemed under-serviced can be a powerful motivator for private companies to modify their behaviour in order to prevent the government from entering their market.

Privatisation and deregulation

Large monopolies, sometimes deemed unresponsive to citizens or consumer wishes, can be threatened with privatisation or with deregulation depending on whether the monopoly is government-owned or not.

See also

References

- Tunde Adeleke, "Afro-Americans and moral suasion: the debate in the 1830s," The Journal of Negro History, 1998: 127-142.

- Romans, J.T. (December 1996). "Moral Suasion as an Instrument of Economic Policy". The American Economic Review. 56 (5): 1220–1226.CS1 maint: ref=harv (link)

- Investopedia, What does moral suasion mean, http://www.investopedia.com/terms/m/moralsuasion.asp (accessed June 1, 2010).

- Paul R. Verkuil, "Jawboning administrative agencies: Ex Parte Contracts by the White House," Columbia Law Review, 1980: 943-989.

- "Constitution of the Assembly". Shimer College. 2014-09-04. Retrieved 2015-01-15.

- Miller, Randall M. "Education". The Greenwood Encyclopedia of Daily Life in America. 4. p. 251. ISBN 9780313065361.

- Greven, Philip J. (2010). "Moral Suasion and Nonviolence". Spare the Rod: The Religious Roots of Punishment and the Psychological Impact of Physical Abuse. p. 30. ISBN 9780307773005.

- "Moral Suasion". Alcohol and Drugs in North America: A Historical Encyclopedia. p. 472.

- Martin, Waldo (2013). "Civil Rights, African American". The New Encyclopedia of Southern Culture: Volume 24: Race. p. 72.CS1 maint: ref=harv (link)

- Martin 2013, p. 78.

- Straits Times, "Govt will step in when efforts fail," Straits Times, March 6, 2010

- S. Zekri, "Analyse comparative d'instruments de lutte contre la pollution," in Séminaire de l'Association Tunisienne des Anciens de l'Institut Agronomique Méditerranéen de Zaragoza (Tunis: CIHEAM-IAMZ, 1993), 61-73

- James M. Coe and Donald B. Rogers, Marine Debris, Sources, Impacts, and solutions (New York: Springer-Verlag, 1997)

- G.C.van Kooten & Andrew Schmitz, "Preserving Waterfowl Habitat on the Canadian Prairies: Economic Incentives versus Moral Suasion," American Journal of Agricultural Economics, 1992: 79-89

- Vaish, M.C. Essentials of Macroeconomic Management (1st ed.). Vikas Publishing House. p. 426. ISBN 9788125928584.

- Romans 1996, p. 1223.

- Andrei Shleifer, "Does Competition Destroy Ethical Behavior?," The American Economic Review (American Economic Association) 94, no. 2 (May 2004): 414-418

- John F. Chant & Keith Acheson, "The Choice of Monetary Instruments and the Theory of Bureaucracy," Public Choice Vol. 12 (Spring, 1972), 1972: 13-33

- Albert Breton and Ronald Wintrobe, "A theory of 'moral' suasion," The Canadian Journal of Economics / Revue canadienne d'Economique, 1978: 210-219

- Donald T. Brash, "Inflation targeting 14 years on," Speech to the American Economics Association by the chairman of the Reserve Bank of New Zealand (Atlanta, January 5, 2002).

- Lars E. O. Svensson, http://people.su.se/~leosven/, January 26–27, 2004, (accessed May 28, 2010).

- Editor in Chief Hama Saburi Financial Gazette, "http://www.newzimbabwe.com," http://www.newzimbabwe.com/opinion-2111-Interview+Gono+on+Indigenisation/opinion.aspx, March 26, 2010, (accessed May 28, 2010)

- Carl H. Madden, "Government Control versus Market Discipline," Academy of Political Science, 1979: 203-218

- Amihai Glazer and Henry McMillan, "Pricing by the Firm Under Regulatory Threat," The Quarterly Journal of Economics, 1992: 1089-1099

- John A. Vernon and Carmelo Giaccotto, "The impact of indirect government controls on U.S. drug prices and R&D," Cato Journal, 2006: 143-158

- The Economist, "Moral outrage," The Economist, October 22, 2009.

- Wall Street Journal, "House Passes Bonus Tax Bill" Wall Street Journal, March 20, 2009.

- John Williamson, "The case for Roughly Stabilizing the Real Value of the Dollar," The American Economic Review, 1989: 41-45

- Kai Hong Phua, "Privatization and restructuring of health services in Singapore," IPS occasional paper series (Singapore: Institute of Policy Studies, 1991).