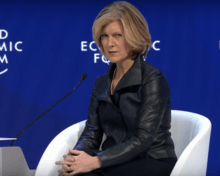

Mary Callahan Erdoes

Mary Callahan Erdoes (born August 13, 1967) is Chief Executive Officer of J.P. Morgan Asset & Wealth Management (a division of JPMorgan Chase), a global leader in investment management and private banking with $2.8 trillion[6] in client assets. She is also a member of JPMorgan Chase & Co.'s Operating Committee.

Mary Callahan Erdoes | |

|---|---|

| |

| Born | Mary Callahan August 13, 1967[1] |

| Nationality | American |

| Alma mater | Georgetown University[2] Harvard Business School[3] |

| Occupation | Asset & Wealth Management CEO at JPMorgan Chase & Co. |

| Net worth | $82.9 million (March 2020)[4] |

| Spouse(s) | Philip Erdoes[3] |

| Children | 3 daughters: Mia, Morgan & Mason[5] |

Early life and education

Mary Callahan was born on 13 August 1967 to Patricia and Patrick Callahan, Jr.. Patrick Callahan was a former partner at investment banking firm Lazard Freres.[7] Callahan Erdoes was raised in Winnetka, Illinois, an affluent North Shore suburb of Chicago.[8][9] She was raised in a Roman Catholic family of Irish descent.[9] Callahan Erdoes is an alumna of the all-girls Roman Catholic Woodlands Academy of the Sacred Heart in Lake Forest, Illinois.[10][11] Erdoes completed her bachelor's degree at Georgetown University, majoring in Mathematics. She was the only woman to complete a mathematics major at Georgetown at that time. She earned her MBA at Harvard Business School.[7]

Career

Callahan Erdoes started her career with Stein Roe & Farnham, and described her maternal grandmother as instrumental for helping her get that job during college. She described her position there as a "glorified mailroom job".[1] She then moved on to Bankers Trust, where she worked in corporate finance, merchant banking, and high-yield debt underwriting. Prior to joining J.P. Morgan, she was employed at Meredith, Martin & Kaye, a fixed-income specialty advisory firm, where she was responsible for credit research, trading, and individual portfolio management. In 1996, she joined J.P. Morgan Asset Management as head of fixed income for high-net-worth individuals, foundations, and endowments.[2] In March 2005, she was appointed CEO of J.P. Morgan Private Bank.[7] She assumed her current post in September 2009. She has been mentioned as a potential successor to JPMorgan Chase & Co. CEO Jamie Dimon.[12]

In 2012, Callahan Erdoes was included in the 50 Most Influential list of Bloomberg Markets. In March 2013, Business Insider included Callahan Erdoes on its list of the 25 most powerful women on Wall Street.[13] In 2016, Callahan Erdoes was named the 60th most powerful woman in the world by Forbes.[14]

She is a board member of Robin Hood,[15] the U.S. Fund for UNICEF.[16] and the U.S.-China Business Council.[17] She also serves on the Federal Reserve Bank of New York's Investor Advisory Committee on Financial Markets.[18]

Epstein Client Retention Allegations

As an executive at JPMorgan, Callahan Erdoes was cited as the main reason JPMorgan retained Jeffrey Epstein as a client for five years, through 2013, after his conviction for sex crimes. The New York Times cited six employees as stating that "the main reason was that Mary C. Erdoes, one of JPMorgan’s highest-ranking executives, intervened to keep him as a client." The Times noted that "Joseph Evangelisti, a JPMorgan spokesman, disputed The New York Times's reporting. 'Mary would never overrule our compliance team or other controls functions to retain a customer,' he said."[19]

Personal life

Callahan Erdoes met her husband Philip Erdoes at Harvard Business School. While Mrs Erdoes is Catholic, her husband is Jewish. They live in New York City with their three daughters.[16]

Callahan Erdoes is a major Republican Party donor and fundraiser. She contributed to the presidential campaigns of John McCain and Mitt Romney in 2008 and 2012, respectively.[20]

References

- "She Does the Math". The New York Times. 4 July 2005. Retrieved 23 March 2011.

- Messina, Judith. "Math Major Takes Major Bank Role". Retrieved 23 March 2011.

- Gupte, Pranay (9 January 2006). "The Difference Between Rich and Wealthy". The New York Sun. Retrieved 23 March 2011.

- https://wallmine.com/people/51073/mary-e-erdoes

- https://www.workingmother.com/most-powerful-moms/most-powerful-moms-finance-pictures#page-4

- https://seekingalpha.com/article/4187177-jpmorgan-chase-and-co-2018-q2-results-earnings-call-slides

- "The Difference Between Rich and Wealthy". The New York Sun. Retrieved 2018-08-18.

- "She Does the Math - The New York Times". 2016-03-13. Archived from the original on 2016-03-13. Retrieved 2018-08-18.

- "Mary Callahan Erdoes: Wall Street's $1 Trillion Woman". 2015-10-18. Archived from the original on 2015-10-18. Retrieved 2018-08-18.

- "Woodlands Academy: Woodlands Alumna Mary Callahan Erdoes '85 Once Again a Forbes Most Powerful Honoree". 2016-03-13. Archived from the original on 2016-03-13. Retrieved 2018-08-18.

- "Woodlands Academy Awards New Alumna Achievement Honor - Lake County News-Sun". 2016-03-14. Archived from the original on 2016-03-14. Retrieved 2018-08-18.

- Keenan, Charles (October 2010). "#6 Mary Callahan Erdoes". American Banker and SourceMedia, Inc. Retrieved 23 March 2011.

- "The 25 Most Powerful Women on Wall Street". Retrieved 20 March 2013.

- "The World's 100 Most Powerful Women". Forbes. Forbes. Retrieved 3 June 2017.

- https://www.robinhood.org/about-us/governance/

- "Mary Callahan Erdoes". Retrieved 23 March 2011.

- https://www.uschina.org/about/board-of-directors

- https://www.newyorkfed.org/aboutthefed/ag_financial_markets.html

- "PMorgan Kept Jeffrey Epstein as a Client Despite Internal Warnings". NYTimes. NYTimes. Retrieved 8 August 2019.

- "JPMorgan Executives Plan Romney New York Fundraiser Next Month - Bloomberg Business". 2016-03-14. Archived from the original on 2016-03-14. Retrieved 2018-08-18.