Honduras and the World Bank

The World Bank Group is a family of five international organizations that has provided leveraged loans and monetary assistance to the Central American country of Honduras in order to assist with the funding of critical tasks needed to ensure security of Honduran access to financing, expansion of social program coverage, and rural development.[1] The country is the second poorest in Central America and its high poverty rate of 66% in 2016 has prompted an increased focus on the importance of diversification of rural income sources, quality education, and targeted social programs as a way of spurring economic growth.[2]

Operating with investments from the International Development Association (IDA), the International Finance Corporation (IFC), and the Multilateral Investment Guarantee Agency (MIGA), the World Bank manages an investment portfolio of over $990 Million US dollars in Honduras in its effort to promote the development of the private and public sector through foreign investment and economic activity.[1] Recent efforts by the World Bank in Honduras have included the Country Partnership network (CPF) finalized December 15, 2015 as a joint effort between the World Bank Group and its IDA, MIGA, and IFC subsidiaries, who have contributed US $169 Million, US $327 million, and $494 million to the Honduran portfolio, respectively.[3] The CPF has seven primary objectives that were formed to "promote inclusion, strengthen growth conditions, and reduce vulnerabilities in the country."[1]

Strategic partnership

IDA

The International Development Association's (IDA) portfolio in Honduras currently holds US $354 million in investments operating through a total nine lending operations spanning a variety of sectors in the region such as public sector management, citizen security, rural development, and social protection. Despite the promising potential that access to $300 has represented for the region, political risk within groundwork by the institution along with problems with implementation logistics have threatened to leave nearly US $100 million in assistance undisbursed with only 5 full-time projects being implemented, including the Improving Public Sector Performance project and the Rural Infrastructure Project, both of which have generally been classified as moderately unsatisfactory in their operation yet nonetheless seen as a positive trend with their relative increase in performance according to IDA standards.

IFC

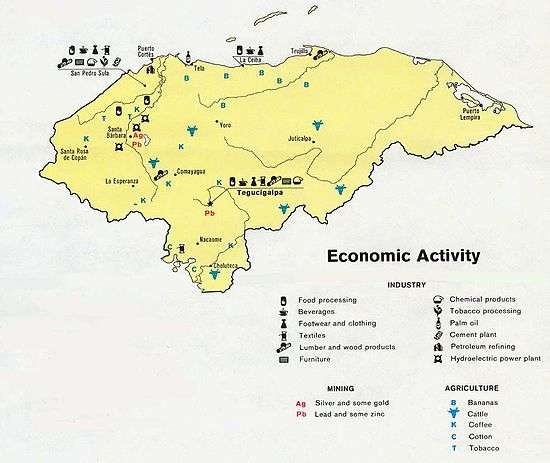

Investments by the International Finance Corporation (IFC) in Honduras also include from $639.7 million in commitment to projects targeted toward Honduras' renewable energy sector, the expansion of the financial sector, and bolstering a competitive climate within agricultural business in rural communities.Operating as the second largest portfolio in Central America with over $630 million, Honduras has experienced growth through 29 successful public-private partnerships in infrastructure projects, as well as investments in four large scale renewable energy projects that are intended to help strengthen Honduras' electronic grid and assist in the development of a strong economy backed by a reliable infrastructure.[4] The IFC has received criticism for providing funding to the palm oil company Dinant due to allegations that the company has engaged in lethal attacks against several co-operatives.[5] The institution has also faced criticism over a 2011 $70m investment to Banco Ficohsa, Honduras' largest bank, with critics stating that the money would be indirectly supplied to Dinant.[6][7] In a December 2013 audit the IFC's ombudsman found that the institution did not perform due diligence when examining the potential social and ecological risks associated with Dinant.[8]

However, in its 2015 report on Honduras, the International Criminal Court stated that "criminal organisations and international drug cartels are deeply involved in local businesses and criminal activities in the region and seem to be involved in most of the alleged crimes in the Bajo Aguán, including unlawful occupations of land and robbery of African palm fruits, in order to retain control of the region and to continue to operate in total impunity."[9]

A class action lawsuit was filed in March 2017 by the NGO EarthRights International on behalf of approximately a dozen anonymous farmers looking for compensation from the World Bank, who they claim “knowingly profiting from the financing of murder” by financing Dinant via the IFC.[10]

In October 2017, the IFC confirmed that Dinant had fully repaid the balance of its outstanding loan and that Dinant had achieved material compliance with IFC’s Performance Standards. The IFC also acknowledged that Dinant had made progress, particularly in implementing the Voluntary Principles on Security and Human Rights (VPSHR) security force protocols.[11]

In November 2017, Dinant defended its former relationship with the World Bank, stating, “The IFC’s loan to Dinant was granted to help us increase production capacity, upgrade our distribution network, enhance the surrounding natural environment, and expand economic opportunities for local communities, particularly in rural areas like the Aguán. Of course, we must continue to improve but, by all these measures and more, the IFC’s loan to Dinant has been a tremendous success. Dinant is now widely recognized as an international benchmark in how to operate a successful business transparently and honestly in one of the most challenging regions in the world.”[12]

MIGA

Operating through three major projects totaling over $US 326 million,The Multilateral Investment Guarantee, or MIGA has also brought potentially major changes in transport and energy sectors. Just recently, as of September 25, 2015, MIGA committed to $187 million in investment guarantees to support the construction of a major effort to connect San Pedro Sula, currently Honduras' 2nd largest city, and La Ceiba near its coast.[13] Honduras will potentially be able to manage more tourist traffic and support it with another MIGA-backed project granting over $80 million US dollars that will expand Honduras' current power grid capacity from 102 megawatts to 126 megawatts with the implementation of a wind farm and massive photovoltaic, (Solar power) projects.[14]

Targeted projects

Operating to improve inclusion, bolster conditions for growth, and reduce vulnerabilities, the Country Partnership Framework's Areas of Engagement have expanded possibilities within the region.[3] A new, targeted approach through a variety of programs in social protections in labor and medicine, rural competitiveness projects in agriculture, and risk disaster management has created some positive outlook for areas across the region prone to lasting damage from hurricanes and typhoons that threaten local and regional farmlands, roads and disrupt economic activity. Projects like the Rural Competitiveness Project managed by the IDA, the IBRD's Nutrition and Social Protection Project, and the Second Project for Highway Reconstruction and Improvement have helped boost Honduras' economic productivity following its slow recovery from the 2008-2009 global recession. Secured agriculture, access to safe infrastructure, and reliable response capacities of local emergency authorities have sparked regional competitiveness and activity in the local economy. The Rural Competitiveness Project alone has created over 9,000 jobs and is responsible for productive partnerships with local business leaders in agricultural production, such as coffee and fruit, some of Honduras' leading exports upon which the livelihood of a vast percentage of the Honduran citizens depend.[15] On May 18, 2017, the World Bank Board of Directors approved a US$25 million loan in additional financing for the Rural Competitiveness Project, focusing on increased adaptation to climate change which has had a direct impact on food insecurity and poverty rates in the region. Should the implementation of new technologies, an estimated 5,500 new rural housing units, and arrangement of 70 business plans be successful in their targeted goals, programs are set to potentially serve directly to local communities in efforts advancing a vibrant economy backed by a strong infrastructure and thriving agricultural competition.[16]

References

- "Honduras Overview". World Bank. Retrieved 2017-06-08.

- "Global Reach Map". Maps.worldbank.org. Retrieved 2017-06-08.

- "PPP Units Around the World". Public private partnership World Bank. Retrieved 2017-06-08.

- Donnan, Shawn (March 8, 2017). "Honduran farmers accuse World Bank arm of 'profiting from murder'". Financial Times. Retrieved 2017-06-08.

- Yukhananov, Anna (August 11, 2014). "World Bank again criticized for investments in Honduras". Reuters.com. Retrieved June 8, 2017.

- Provost, Claire (2014-05-01). "World Bank loan to Honduran bank comes under scrutiny". The Guardian. ISSN 0261-3077. Retrieved 2017-06-08.

- "CAO Audit of IFC Investment in Corporación Dinant S.A. de C.V., Honduras" (PDF). Compliance Auditor Ombudsman. 2013.

- International Criminal Court (October 2015). "Situation in Honduras" (PDF).

- Provost, Claire (2017-03-08). "Farmers sue World Bank lending arm over alleged violence in Honduras". The Guardian. ISSN 0261-3077. Retrieved 2017-06-08.

- "Update on Dinant - October 2017". International Finance Corporation. October 2017.

- "Dinant fully repays IFC loan; company meets requirements of IFC Performance Standard 4 and Enhanced Action Plan". Corporacion Dinant. 27 November 2017.

- "News & Events - Multilateral Investment Guarantee Agency - World Bank Group". Miga.org. Retrieved 20 February 2019.

- "Environmental & Social Sustainability - Multilateral Investment Guarantee Agency - World Bank Group". Miga.org. Retrieved 20 February 2019.

- "Projects : Disaster Risk Management Project | The World Bank". Projects.worldbank.org. Retrieved 2017-06-14.

- "The World Bank Approves US$25 Million to Improve Rural Competitiveness in Honduras". World Bank. Retrieved 2017-06-14.