Backtesting

Backtesting is a term used in modeling to refer to testing a predictive model on historical data. Backtesting is a type of retrodiction, and a special type of cross-validation applied to previous time period(s).

Financial analysis

In a trading strategy, investment strategy, or risk modeling, backtesting seeks to estimate the performance of a strategy or model if it had been employed during a past period. This requires simulating past conditions with sufficient detail, making one limitation of backtesting the need for detailed historical data. A second limitation is the inability to model strategies that would affect historic prices. Finally, backtesting, like other modeling, is limited by potential overfitting. That is, it is often possible to find a strategy that would have worked well in the past, but will not work well in the future.[1] Despite these limitations, backtesting provides information not available when models and strategies are tested on synthetic data.

Backtesting has historically only been performed by large institutions and professional money managers due to the expense of obtaining and using detailed datasets. However, backtrading is increasingly used on a wider basis, and independent web-based backtesting platforms have emerged. Although the technique is widely used, it is prone to weaknesses.[2] Basel financial regulations require large financial institutions to backtest certain risk models.

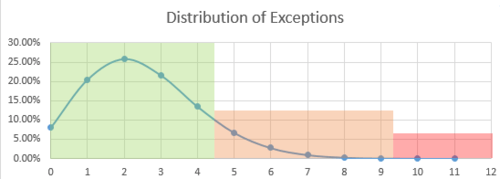

For a Value at Risk 1-day at 99% backtested 250 days in a row, the test is considered green (0-95%), orange (95-99.99%) or red (99.99-100%) depending on the following table[3]:

| Zone | Number exceptions | Probability | Cumul |

|---|---|---|---|

| Green | 0 | 8.11% | 8.11% |

| 1 | 20.47% | 28.58% | |

| 2 | 25.74% | 54.32% | |

| 3 | 21.49% | 75.81% | |

| 4 | 13.41% | 89.22% | |

| Orange | 5 | 6.66% | 95.88% |

| 6 | 2.75% | 98.63% | |

| 7 | 0.97% | 99.60% | |

| 8 | 0.30% | 99.89% | |

| 9 | 0.08% | 99.97% | |

| Red | 10 | 0.02% | 99.99% |

| 11 | 0.00% | 100.00% | |

| ... | ... | ... |

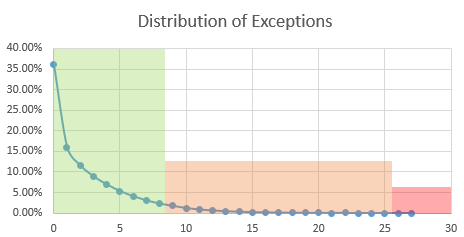

For a Value at Risk 10-day at 99% backtested 250 days in a row, the test is considered green (0-95%), orange (95-99.99%) or red (99.99-100%) depending on the following table:

| Zone | Number exceptions | Probability | Cumul |

|---|---|---|---|

| Green | 0 | 36.02% | 36.02% |

| 1 | 15.99% | 52.01% | |

| 2 | 11.58% | 63.59% | |

| 3 | 8.90% | 72.49% | |

| 4 | 6.96% | 79.44% | |

| 5 | 5.33% | 84.78% | |

| 6 | 4.07% | 88.85% | |

| 7 | 3.05% | 79.44% | |

| 8 | 2.28% | 94.17% | |

| Orange | 9 | 1.74% | 95.91% |

| ... | ... | ... | |

| 24 | 0.01% | 99.99% | |

| Red | 25 | 0.00% | 99.99% |

| ... | ... | ... |

Hindcast

In oceanography[5] and meteorology,[6] backtesting is also known as hindcasting: a hindcast is a way of testing a mathematical model; researchers enter known or closely estimated inputs for past events into the model to see how well the output matches the known results.

Hindcasting usually refers to a numerical-model integration of a historical period where no observations have been assimilated. This distinguishes a hindcast run from a reanalysis. Oceanographic observations of salinity and temperature as well as observations of surface-wave parameters such as the significant wave height are much scarcer than meteorological observations, making hindcasting more common in oceanography than in meteorology. Also, since surface waves represent a forced system where the wind is the only generating force, wave hindcasting is often considered adequate for generating a reasonable representation of the wave climate with little need for a full reanalysis. Hydrologists use hindcasting for model stream flows.[7]

An example of hindcasting would be entering climate forcings (events that force change) into a climate model. If the hindcast showed reasonably-accurate climate response, the model would be considered successful.

The ECMWF re-analysis is an example of a combined atmospheric reanalysis coupled with a wave-model integration where no wave parameters were assimilated, making the wave part a hindcast run.

Unintended outcomes of application

In 2003, Dake Chen and his colleagues initially "trained" a computer, using the data of the surface temperature of the oceans from the last 20 years.[8]

Then, having "trained" the computer, they conducted a hindcasting exercise using data that had been collected on the surface temperature of the oceans for the period 1857 to 2003. Not only did they find that their simulation accurately predicted every El Niño event for the last 148 years, but they also discovered — as an entirely "unintended consequence' of that exercise — that their simulation also identified the (up to 2 years) looming foreshadow of every single one of those El Niño events.[9]

See also

- Algorithmic trading

- Black box model

- Climate

- ECMWF re-analysis

- Forecasting

- NCEP re-analysis

- Program trading

- Retrodiction

- Statistical arbitrage

- Thought Experiment

- Value at risk

References

- BacktestBroker. "Does Backtesting Really Work?".

- FinancialTrading (2013-04-27). "Issues related to back testing".

- "Supervisory framework for the use of "backtesting" in conjunction with the internal models approach to market risk capital requirements" (PDF). Basle Committee on Banking Supervision. January 1996. p. 14.

- Taken from p.145 of Yeates, L.B., Thought Experimentation: A Cognitive Approach, Graduate Diploma in Arts (By Research) dissertation, University of New South Wales, 2004.

- "Hindcast approach". OceanWeather Inc. Retrieved 22 January 2013.

- Huijnen, V.; J. Flemming; J. W. Kaiser; A. Inness; J. Leitão; A. Heil; H. J. Eskes; M. G. Schultz; A. Benedetti; J. Hadji-Lazaro; G. Dufour; M. Eremenko (2012). "Hindcast experiments of tropospheric composition during the summer 2010 fires over western Russia". Atmos. Chem. Phys. 12 (9): 4341–4364. Bibcode:2012ACP....12.4341H. doi:10.5194/acp-12-4341-2012. Retrieved 22 January 2013.

- "Guidance on Conducting Streamflow Hindcasting in CHPS" (PDF). NOAA. Retrieved 22 January 2013.

- Chen, D., Cane, M.A., Kaplan, A., Zebiak, S.E. & Huang, D., "Predictability of El Niño Over the Past 148 Years", Nature, Vol.428, No.6984, (15 April 2004), pp.733-736; Anderson, D., "Testing Time for El Niño", Nature, Vol.428, No.6984, (15 April 2004), pp.709, 711.

- Not only did hindcasting demonstrate that the computerized simulation models could predict the onset of El Niño climatic events from changes in the temperature of the ocean's surface temperature that occur up to two years earlier — meaning that there was now, potentially, at least 2 years' lead time — but the results also implied that El Niño events seemed to be the effects of some causal regularity; and, therefore, were not due to simple chance, or to some other "chaotic" event.