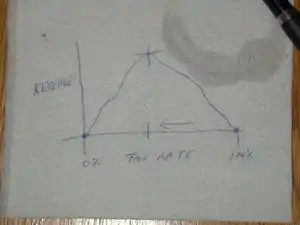

Laffer curve

The Laffer curve is a theoretical relationship between tax rates and tax revenues. It is named after the economist Arthur Laffer, although he does not claim to have invented it and he learned it from Ibn Khaldun and John Maynard Keynes.[2] The graph, famously sketched on a restaurant napkin, purport to show that under certain specific circumstances, a major cut in marginal income tax rates, along with careful spending discipline for the ensuing short term, will, in the long term, actually increase tax revenue.

| The dismal science Economics |

| Economic Systems |

|

$ Market Economy |

| Major Concepts |

| People |

|

v - t - e |

“”Nor should the argument seem strange that taxation may be so high as to defeat its object, and that, given sufficient time to gather the fruits, a reduction of taxation will run a better chance, than an increase, of balancing the Budget. |

| —John Maynard Keynes[1] |

The term "voodoo economics" was used by George H. W. Bush, during the Republican primary campaign in 1980, referring to Saint Ronnie's reckless promotion of supply-side economics.

It was thought that at that time in US history, the tax rates and current budget fell within the window of what Laffer predicted. When Reagan attained the Presidency, he did indeed pursue an aggressive program of tax reduction — however, the required corresponding budget discipline was ignored as he went on a military borrowing and spending spree to fight the commies. Apologists for Reagan (and supply-side economics in general), of course, blamed the Democratic-led Congress for the spending.

The Laffer curve is often used as a blanket ideological justification to reduce income taxes, especially the higher marginal rates paid by high-income individuals, regardless of where current tax rates might lie on it. Laffer is like a nutritionist who points out that because people who eat nothing die of starvation, the problem with obese people is that they are eating too little—and is then lauded as a genius of his field.

Argument

The main argument using the Laffer curve to cut taxes is as follows:

- If the income tax rate were 0 percent, the government gets zero revenue because it isn't collecting any money.

- If the income tax rate were 100 percent, nobody has an incentive to work in taxable jobs[3] because nobody gets to actually keep any money they earn. So nobody works in taxable jobs. When nobody works in taxable jobs, nobody has taxable income to tax. Therefore, the government gets zero revenue in this instance also.

- Given 1 and 2, the government revenue is maximized at some tax rate between 0 and 100 percent. The Laffer curve is a plot of government revenue as a function of tax rate. It is zero at 0% and 100% tax rates, and it looks something like a parabola (you should know this from mathematics class). Where the maximum occurs is a wild-ass guess. (Or, one could try to use some method like binary bisection or graphing means to find the maximum. We've done this with interesting results, see below.)

- Given 3, taxes should therefore be slashed.

Why the argument is nowhere close to being valid in the United States

Unfortunately, economics sometimes requires drawing what appears to be a hand-wavy curve between two points, that has much more meaning to real economists but may not be well understood by partisans. To make a statement that cutting taxes will always raise tax revenue is simply ridiculous.

- Premise 2 is easily challenged. Obviously a country can't have a 100% tax rate; if nobody works in a taxable job, this would mean nobody is working any jobs other than subsistence farming, thereby setting the country back by roughly ten thousand years (though it could also be held to reflect an economy where all wealth distribution was managed directly by the government). However, even if the top-earner tax rate was very high (say, 90%), people would still work. After all, keeping 10 percent of your wages is better than earning nothing at all. Indeed, the highest income tax bracket rate in the United States was close to 90% during World War II, and everything seemed to work just fine then (albeit, this was for those making $100K then, before inflation[4]).

- Point 4 above does not necessarily follow from the prior points. Assuming the Laffer curve's assumptions are correct, cutting taxes would only increase government revenue if the current tax rate is greater than the "optimal" tax rate (where "optimal" means the rate that maximizes government revenue, not necessarily the optimal tax rate for the overall economy and society). If the current tax rate is on the wrong (left) side of the maximum in the Laffer curve, cutting taxes decreases revenue, which counteracts the whole point of mentioning the curve in the first place. To justify cutting taxes on the basis of raising revenue, the Laffer curve's proponents have to, first, define the "ideal" tax rate that maximizes revenue (which requires doing your math homework); and, secondly showing that the current tax rate is on the high side of the "optimal" (as defined above) tax rate. You can't just shout "Laffer curve!" decrease taxes, and expect everything to be great. (And that's what Saint Ronnie actually did.)

- Doing the actual work required shows the Laffer curve calls to increase taxes right now. One study of the United States between 1959 and 1991 placed the revenue-maximizing tax rate (the point at which another tax rate increase would decrease tax revenue) at between 32.67% and 35.21%.[5] In 1991 the "average" tax rate was 19.58%. The US is currently on the lower side of the maximum tax rate predicted by Laffer's curve. Hsing also concluded that Reagan's tax cuts reduced revenue, since the average tax rate at the time was only 20.41%. This means Laffer's curve has completely backfired in what it was said it was supposed to do (increase government revenue).

- The tax rate the Laffer curve deals with is an "average" or overall rate. In a progressive tax system, lower income people should be paying, approximately, a total tax of 10-15% and upper income people in the 60-70% range, comparable to the 70% that was found to give an optimal result in Sweden in the 1970s.[6] And despite that marginal rate since being lowered to +55% in Sweden (the shortfall resulting in sales tax increases), it is still well higher than the the highest federal bracket in the US — 35% — in 2011. A worker earning about $20,000 a year pays a 15% income tax plus almost 15% in "payroll" taxes towards the Social Security and Medicare/Medicaid programs, or about 8% less than the tax rate paid by someone earning a hundred times as much.[7]

- It’s invoked to justify objectives opposite to those it purports to achieve. The whole point of the Laffer curve is to set taxes at the “optimal” level, where the curve reaches its peak, in order to maximize government revenue. But it is then cited to justify endless tax cuts, by those who seek to minimize government revenue, to reduce government spending by “starving the beast.” This non sequitur goes almost universally unnoticed by both advocates and opponents of the policy.

- It focuses on the wrong segment of the population. The people that'd theoretically benefit the most from the tax cut would be those facing the highest effective tax rate; the people on welfare. Due to the rules about means-testing for things like housing assistance, food stamps, and healthcare, make juuust enough money and you lose it all. Oh sure, it's phased out, but the end result is that it's still effectively a tax. Earn an extra $10,000 this year? Screw you, you don't need these $6,000 worth of food stamps and housing benefits, oh and you can now afford to pay an extra $2000 in tax, oh and this is after we tax your money through your employer before you even see it! And this is BEFORE Social Security which for some stupid reason is only levied on the first $110,000. This is known as the Welfare trap

File:Wikipedia's W.svg . It's almost as if the system is designed to prevent people from escaping poverty. So even if the Laffer Curve was true, the rich are the last group that need the cut.

See also

- Sam Brownback — Laffer's handiwork can be seen in Brownbackistan which is currently on a "

deathmarch to zero."[8] See? Now it's not feudalism; it's an exciting new economic experiment!

External links

References

- John Maynard Keynes (1933). The Means to Prosperity.

- "The Laffer Curve: Past, Present, and Future".

- Subsistence farming in an unincorporated area (so there is no property tax) is an example of a non-taxable job (the farmer has nothing to sell for profit so the farmer has nothing to be taxed).

- http://www.taxfoundation.org/publications/show/151.html

- Estimating the Laffer curve and policy implications, Hsing, Y. (1996). Journal of Socio-Economics, 25 (3), pp 395–401.

- Swedish tax rates, labor supply and tax revenues. Stuart, C., 1981. Journal of Political Economy, 89, pp. 1020–1038.

- It may seem confusing, but payroll taxes only apply to the first $110,000 of income. Oh and this is after the employer is taxed on the wages; a way of taxing people without them actually seeing it.

- Binelli, Mark, "The Great Kansas Tea Party Disaster", 23 October 2014.